My paycheck after taxes

That means that your net pay will be 43041 per year or 3587 per month. Your average tax rate is.

Paycheck Calculator Online For Per Pay Period Create W 4

Get an accurate picture of the employees gross pay.

. Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also. Next divide this number from the. This means you pay 1285266 in taxes on an annual salary of.

How Your Texas Paycheck Works. Without the help of a paycheck calculator its tricky to figure out what your take-home pay will be after taxes and other monies are withheld. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

Even if you did a Paycheck. States you have to pay federal income and FICA taxes. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. If you make 55000 a year living in the region of New York USA you will be taxed 11959. There is a line on the W-4 that.

Your employer withholds a 62 Social Security tax and a. Free salary hourly and more paycheck calculators. However after taxes 15 per hour would be reduced to around 1188 to 1284 depending on the state you live in.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. How do I calculate hourly rate. Given you file as a single taxpayer you will only pay federal taxes.

Adjusted gross income - Post-tax deductions Exemptions Taxable income. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Your paychecks will be smaller but youll pay your taxes more accurately throughout the year.

This federal hourly paycheck. How Your Tennessee Paycheck Works. Thus 67000 annually will net you 54147.

When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Taxable income Tax rate based on filing status Tax liability. Our calculators are easy to use and allow you to punch in numbers and get real results.

You can also specify a dollar amount for your employer to withhold. Its important to revisit your tax withholding especially if major changes from the Tax Cuts and Jobs Act affected the size of your refund this year. We make taxes just a little easier.

Your refund is the difference between your withholding and the actual tax burden. How Your Pennsylvania Paycheck Works. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Also deducted from your paychecks are any pre-tax retirement contributions you make. As is the case in all US. It can also be used to help fill steps 3 and 4 of a W-4 form.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. How much is 15 an hour after taxes. Your employer pays an additional 145 the employer part of the Medicare tax.

Since our free online calculators arent associated. There are no income limits for Medicare tax so all covered wages are subject to Medicare tax. While your employer typically covers 50 of your FICA taxes this is.

Federal Salary Paycheck Calculator. While withhold larger amount certainly brings more likelihood that you will get bigger. These are contributions that you make before any taxes are withheld from your paycheck.

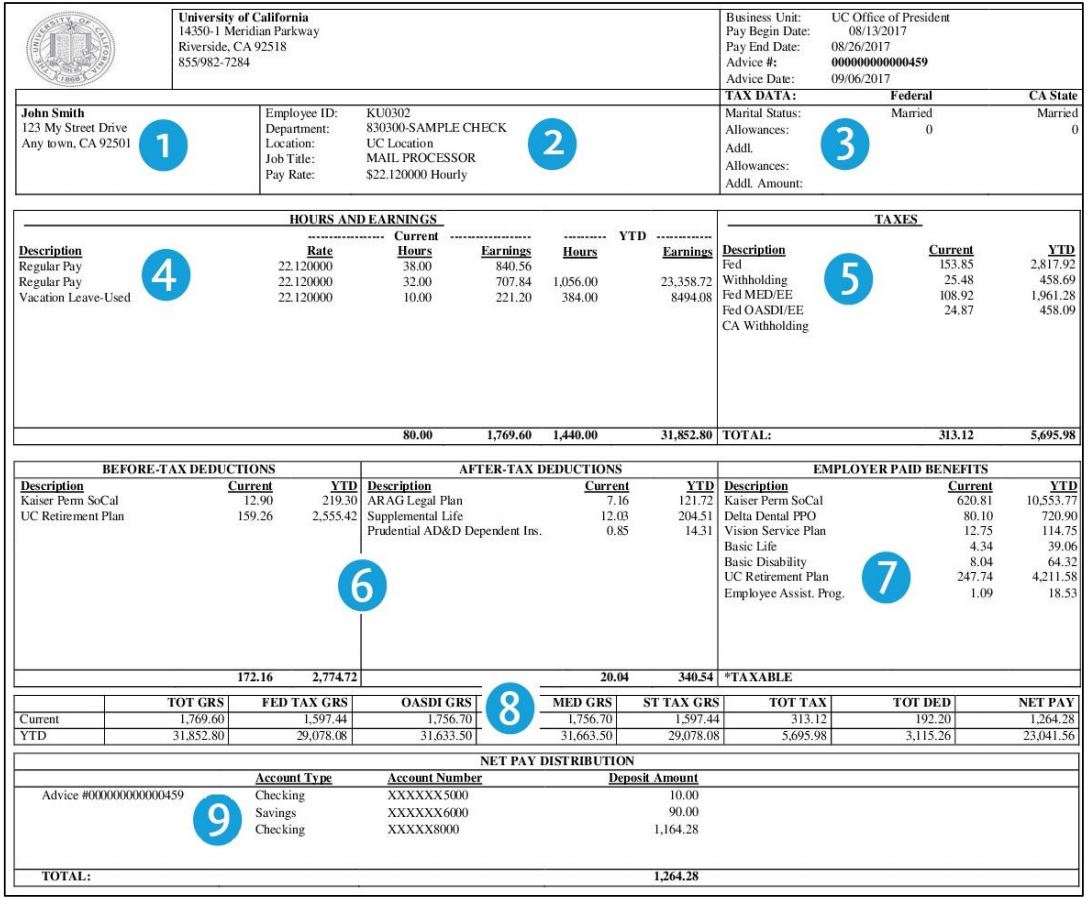

New Paycheck Ucpath

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Understanding Your Paycheck Credit Com

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Taxes Federal State Local Withholding H R Block

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Here S How Much Money You Take Home From A 75 000 Salary

Taxes On Paycheck Store 54 Off Www Ingeniovirtual Com

Check Your Paycheck News Congressman Daniel Webster

My Paycheck Administrative Services Gateway University At Buffalo

Here S How Much Money You Take Home From A 75 000 Salary

Tax Information Career Training Usa Interexchange

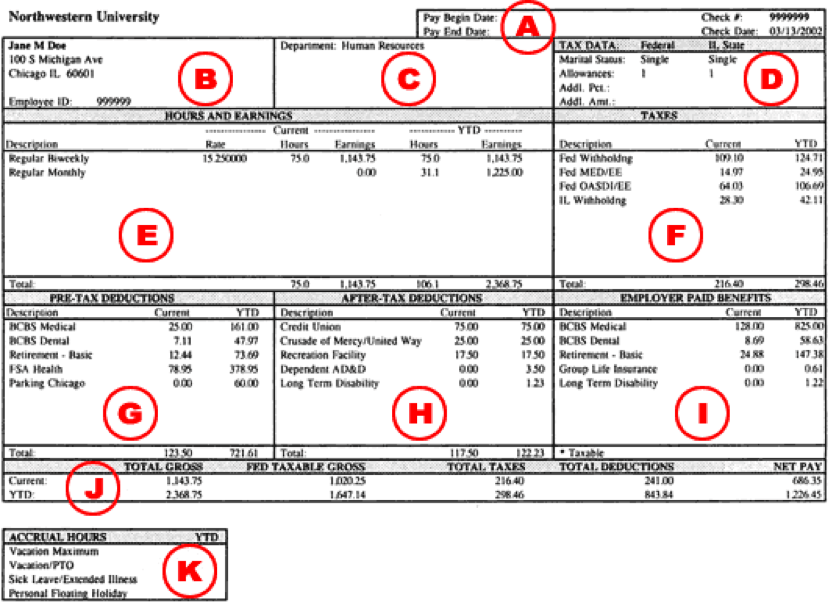

Understanding Your Paycheck Human Resources Northwestern University

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Understanding Your Paycheck